Smart Contracts: The Building Blocks of Decentralized Applications

Smart contracts represent one of the most revolutionary applications of blockchain technology. These self-executing programs have the potential to transform how we create and enforce agreements, eliminating intermediaries and creating new forms of trust in digital interactions.

What Are Smart Contracts?

At their core, smart contracts are programs stored on a blockchain that automatically execute when predetermined conditions are met. Think of them as digital vending machines: you insert the correct payment, and the machine automatically dispenses your selection without requiring a human operator.

The term “smart contract” was coined by computer scientist Nick Szabo in 1994, long before blockchain technology existed. Szabo envisioned digital protocols that could facilitate, verify, and enforce contract terms automatically. However, it wasn’t until the launch of Ethereum in 2015 that smart contracts became practical and widely adopted.

Unlike traditional contracts that require legal systems and human enforcement, smart contracts execute automatically based on code. When specific conditions are met, the contract performs its programmed actions without any possibility of interference, censorship, or third-party manipulation.

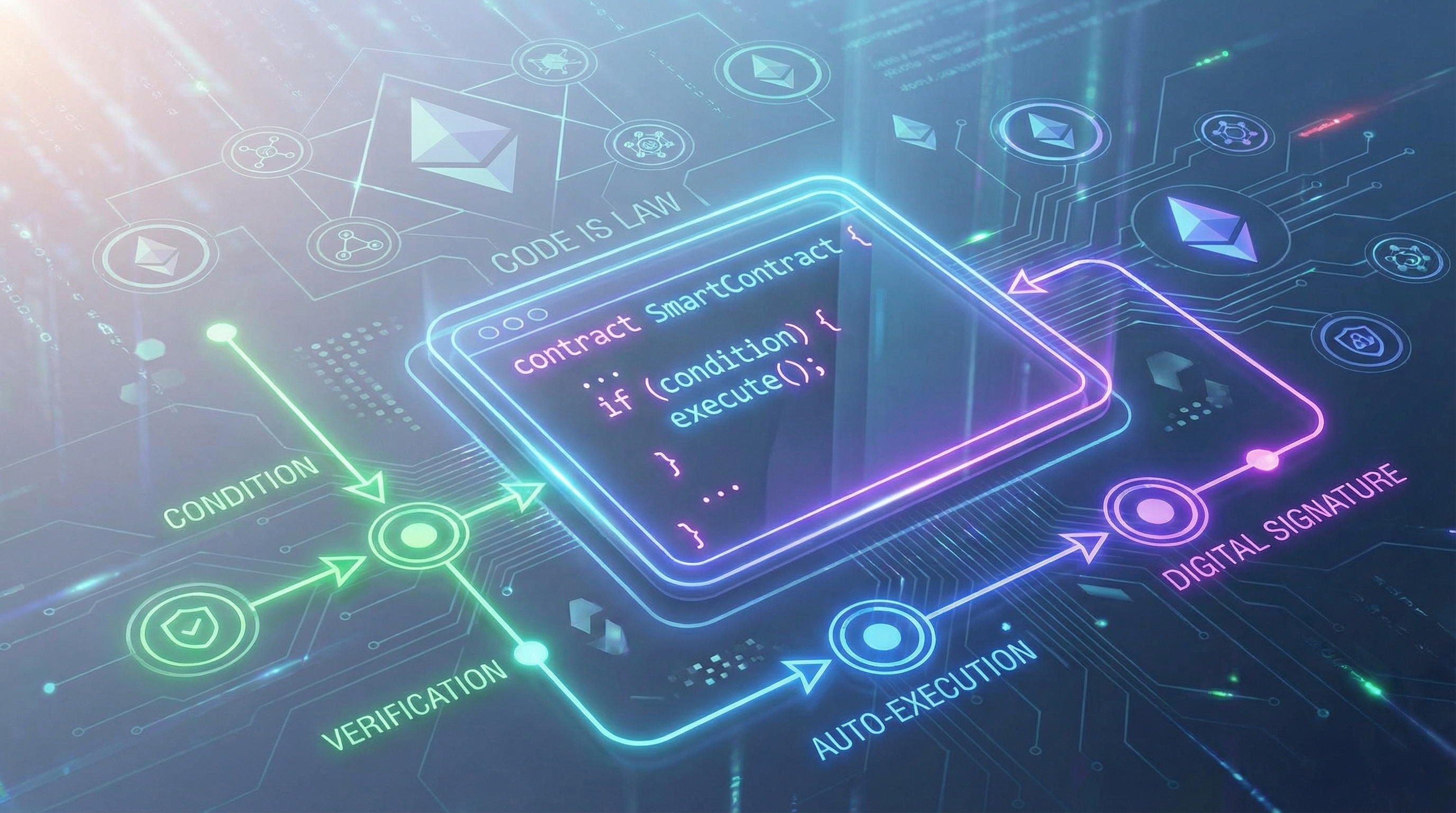

How Smart Contracts Work

Smart contracts operate on blockchain networks, most commonly Ethereum. When a smart contract is deployed, its code is stored permanently on the blockchain, creating an immutable record that anyone can verify. This transparency is crucial for building trust in decentralized systems.

The execution process follows a straightforward pattern. First, parties agree on contract terms and encode them into a smart contract program. The contract is then deployed to the blockchain, where it receives a unique address. When someone interacts with the contract by sending a transaction, the blockchain network validates the transaction and executes the contract code.

Every node in the network runs the same code and reaches consensus on the outcome, ensuring that execution is deterministic and tamper-proof. The results are recorded on the blockchain, creating a permanent audit trail of all contract interactions.

Programming Smart Contracts

Ethereum smart contracts are typically written in Solidity, a programming language designed specifically for this purpose. Solidity resembles JavaScript in syntax but includes features tailored for blockchain development, such as built-in support for cryptocurrency transfers and blockchain-specific data types.

A simple smart contract might look like this:

contract SimpleStorage {

uint256 private storedData;

function set(uint256 x) public {

storedData = x;

}

function get() public view returns (uint256) {

return storedData;

}

}

This basic contract stores a number and allows anyone to read or update it. Real-world contracts are far more complex, often involving multiple functions, access controls, and interactions with other contracts.

Decentralized Finance (DeFi)

The most prominent application of smart contracts is decentralized finance. DeFi protocols use smart contracts to recreate traditional financial services without banks or intermediaries. Users can lend, borrow, trade, and earn interest on their cryptocurrency holdings through automated protocols.

Lending protocols like Aave and Compound allow users to deposit cryptocurrency and earn interest, or borrow against their holdings. Smart contracts automatically manage interest rates based on supply and demand, liquidate undercollateralized positions, and distribute rewards to participants.

Decentralized exchanges (DEXs) like Uniswap enable peer-to-peer trading without centralized order books. Automated market maker (AMM) contracts maintain liquidity pools and calculate exchange rates algorithmically, allowing anyone to trade tokens instantly.

Yield farming and liquidity mining protocols incentivize users to provide liquidity to DeFi platforms. Smart contracts automatically distribute rewards based on participation, creating complex economic systems that operate entirely through code.

Non-Fungible Tokens (NFTs)

Smart contracts power the NFT ecosystem, enabling unique digital assets with verifiable ownership and provenance. NFT contracts implement standards like ERC-721 and ERC-1155, which define how tokens are created, transferred, and tracked.

These contracts can include royalty mechanisms that automatically pay creators a percentage of secondary sales, solving a long-standing problem in digital art markets. They can also implement complex logic for dynamic NFTs that change based on external conditions or user interactions.

Gaming applications use NFT smart contracts to create in-game items that players truly own and can trade freely. This enables new economic models where players can earn real value from their gaming activities.

Decentralized Autonomous Organizations (DAOs)

DAOs use smart contracts to create organizations governed by code rather than traditional hierarchies. Token holders vote on proposals, and smart contracts automatically execute approved decisions. This enables transparent, democratic governance without centralized control.

Treasury management contracts hold and distribute funds based on DAO votes. Governance contracts manage voting processes, ensuring that only token holders can participate and that votes are counted accurately. Execution contracts implement approved proposals automatically once voting concludes.

Successful DAOs like MakerDAO govern multi-billion dollar protocols entirely through smart contracts and community voting. This demonstrates that complex organizations can operate effectively without traditional corporate structures.

Security Challenges

Smart contract security is paramount because code vulnerabilities can lead to catastrophic losses. Once deployed, contracts are immutable, meaning bugs cannot be easily fixed. Several high-profile hacks have exploited smart contract vulnerabilities, resulting in hundreds of millions of dollars in losses.

Common vulnerabilities include reentrancy attacks, where malicious contracts repeatedly call back into vulnerable contracts before state updates complete. Integer overflow and underflow can cause unexpected behavior when numbers exceed their maximum or minimum values. Access control issues may allow unauthorized users to call privileged functions.

Developers employ various strategies to mitigate these risks. Formal verification uses mathematical proofs to verify that contracts behave correctly under all conditions. Security audits by specialized firms identify vulnerabilities before deployment. Bug bounty programs incentivize white-hat hackers to find and report issues.

Gas Optimization

Every operation in a smart contract consumes “gas,” a measure of computational work that users must pay for. Inefficient contracts can become prohibitively expensive to use, especially during periods of high network congestion.

Optimization techniques include minimizing storage operations, which are particularly expensive. Using memory instead of storage when possible, packing variables efficiently, and avoiding unnecessary computations can significantly reduce gas costs.

Layer 2 scaling solutions like Optimism and Arbitrum reduce gas costs by processing transactions off the main Ethereum chain while inheriting its security guarantees. These solutions make smart contracts more accessible and practical for everyday use.

The Future of Smart Contracts

Smart contract technology continues to evolve rapidly. Cross-chain bridges enable contracts on different blockchains to interact, creating a more interconnected ecosystem. Oracle networks like Chainlink provide reliable external data to smart contracts, enabling them to respond to real-world events.

Zero-knowledge proofs allow contracts to verify information without revealing underlying data, enabling privacy-preserving applications. This technology could enable confidential financial transactions while maintaining the benefits of blockchain transparency.

Formal verification tools are becoming more sophisticated, making it easier to prove contract correctness mathematically. Improved development frameworks and testing tools help developers write more secure code.

Real-World Adoption

Beyond cryptocurrency, smart contracts are finding applications in supply chain management, where they track products from manufacture to delivery. Insurance companies are exploring automated claims processing through smart contracts that pay out based on verifiable events.

Real estate transactions could be streamlined through smart contracts that automatically transfer ownership when payment conditions are met. Identity verification systems could give users control over their personal data while enabling selective disclosure to authorized parties.

Governments are experimenting with blockchain-based voting systems that use smart contracts to ensure transparent, tamper-proof elections. These applications demonstrate the technology’s potential to improve trust and efficiency in critical systems.

Conclusion

Smart contracts represent a fundamental shift in how we create and enforce agreements. By encoding trust in code rather than relying on intermediaries, they enable new forms of cooperation and economic activity. The technology has already transformed finance through DeFi and created new markets for digital assets through NFTs.

However, smart contracts are still maturing. Security challenges, scalability limitations, and user experience issues must be addressed before mainstream adoption becomes practical. The immutability that makes smart contracts trustworthy also makes mistakes costly and difficult to correct.

As the technology evolves, we’ll likely see smart contracts become more sophisticated, secure, and accessible. They’ll integrate with traditional systems, creating hybrid solutions that combine the best of centralized and decentralized approaches. The ultimate impact of smart contracts will depend on how well we can harness their potential while managing their risks and limitations.

The revolution in programmable trust has only just begun, and smart contracts will play a central role in shaping the decentralized future of technology and society.